Understanding economic events is no longer optional; it’s essential for traders looking to make informed decisions. With markets reacting instantly to news, knowing what to expect and when can be the difference between a successful trade and a missed opportunity. The US economic calendar serves as a powerful tool, offering insights into key announcements, trends, and data releases that shape the market landscape. This quick guide explores how traders can leverage economic news to optimize their strategies and identify actionable opportunities.

Why the US Economic Calendar Matters

Economic events in the United States carry global significance. From employment reports to Federal Reserve decisions, these events can trigger sharp price movements in currencies, stocks, and commodities. By using the US economic calendar, traders can anticipate volatility, position themselves strategically, and manage risk effectively.

Understanding the timing of major announcements is crucial. For example, reports such as nonfarm payrolls or GDP growth figures are closely monitored by investors worldwide. Markets often react before the numbers are fully digested, offering opportunities for quick, informed trades. Without this awareness, traders may be caught off guard, leading to unexpected losses or missed profits.

Key Economic Indicators to Watch

The US economy produces a wide range of reports, but some carry more weight in financial markets than others. Knowing which indicators to focus on can help traders prioritize their attention.

Nonfarm Payrolls (NFP)

NFP is one of the most closely watched economic indicators. Released monthly by the Bureau of Labor Statistics, it reflects changes in employment outside the farming sector. Traders watch this figure for signs of economic growth or contraction. A stronger-than-expected NFP often boosts confidence in the dollar, while weaker numbers may trigger market caution.

Consumer Price Index (CPI)

Inflation data is another critical component. The CPI measures the change in the price of goods and services over time. Rising inflation may influence interest rate expectations, prompting movements in currency and bond markets. Traders can use CPI data to predict potential shifts in monetary policy and adjust their strategies accordingly.

Gross Domestic Product (GDP)

GDP growth indicates the overall health of the economy. Strong GDP numbers generally signal a robust economy, attracting investment in stocks and the dollar. Conversely, slower growth can create uncertainty, offering traders potential short-term opportunities in certain sectors.

Federal Reserve Announcements

Interest rate decisions and monetary policy statements from the Federal Reserve significantly impact market sentiment. Traders who anticipate these moves can align their trades to capitalize on potential volatility. Even subtle changes in language or forward guidance can trigger substantial market reactions.

How to Interpret Economic News for Trading

Simply knowing the schedule of events is not enough. Successful traders also understand how to interpret the data and anticipate market reactions.

Look Beyond the Headlines

Economic reports often make the news with bold numbers and catchy headlines, but it’s important to examine the details. For instance, an increase in jobs may seem positive, but if wage growth remains stagnant, it might indicate underlying economic weakness. Traders who dig deeper can spot trends and identify more reliable opportunities.

Analyze Market Expectations

Markets often move in anticipation of economic news. By comparing actual results to forecasts, traders can gauge sentiment and adjust positions. For example, if the market expects a GDP increase of 2% but the report shows 2.5%, the difference can trigger sharp price movements. Understanding these expectations allows traders to position themselves ahead of the crowd.

Correlate Multiple Indicators

No single data point tells the full story. Successful traders correlate different indicators to get a comprehensive view. For instance, rising employment and wages combined with steady inflation may indicate a strong economy poised for growth, providing confidence in equity markets. By integrating multiple signals, traders can reduce risk and enhance potential returns.

Strategies to Capitalize on Economic Events

Trading around economic news requires careful planning. Here are some strategies to consider:

Pre-Event Positioning

Traders sometimes open positions before major announcements, anticipating the outcome. This approach requires a thorough understanding of market expectations and careful risk management. While potentially profitable, pre-event trades carry higher risk due to unexpected data.

Post-Event Reaction

Many traders prefer to act after the news is released. By observing market reactions, they can identify opportunities that align with actual results rather than forecasts. This strategy can reduce uncertainty, allowing traders to make decisions based on confirmed information.

Volatility-Based Trading

Economic events often create short-term volatility. Traders can use tools such as stop-loss and take-profit orders to navigate rapid price swings. Scalping or day trading strategies can benefit from heightened volatility, but careful monitoring is essential to avoid significant losses.

Diversification and Risk Management

Even with careful analysis, markets can behave unpredictably. Diversifying trades across assets or using hedging strategies can protect capital. Incorporating risk management techniques ensures that unexpected market reactions do not derail long-term trading objectives.

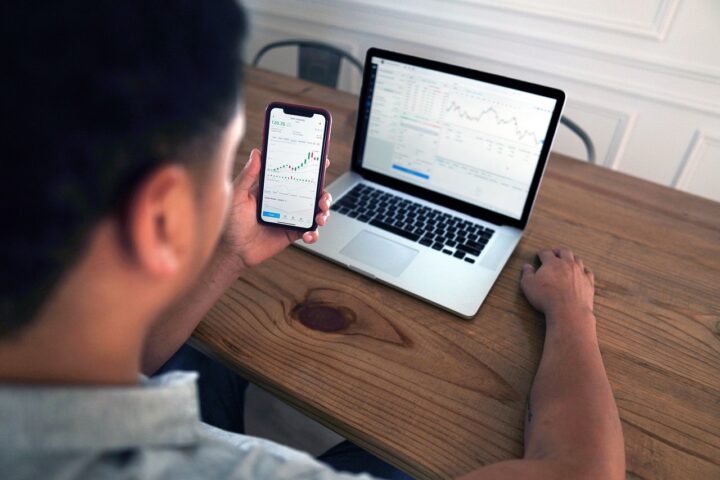

Tools to Enhance Economic News Trading

In addition to a well-maintained US economic calendar, traders can leverage various tools to improve their efficiency and accuracy.

- Economic Dashboards: Visual representations of upcoming events, highlighting their potential impact.

- Alerts and Notifications: Real-time updates on major announcements help traders respond quickly.

- Historical Data Analysis: Examining past market reactions can provide insights into potential outcomes.

- Technical Analysis Integration: Combining economic news with chart patterns enhances decision-making.

Using these tools allows traders to maintain an edge, react promptly, and optimize their trading strategies around critical economic events.

Conclusion

The US economic calendar is more than just a schedule of announcements; it’s a roadmap for traders looking to turn news into opportunities. By understanding the timing, interpreting data effectively, and employing strategic approaches, traders can capitalize on market movements while managing risk.

For those aiming to refine their trading strategies and make smarter, informed decisions, exploring platforms that provide real-time economic data and analytics can be invaluable. Such resources empower traders to react quickly, gain insights, and identify opportunities as they arise, helping transform economic news into tangible trading advantages.TradingView offers a powerful platform with real-time economic data, analytics, and customizable alerts. By leveraging its tools, traders can quickly react to market-moving events, gain actionable insights, and turn economic news into profitable trading opportunities.

Brilliant breakdown! Turning economic news into actionable trading insights is a skill, and this blog post makes the process incredibly clear and practical.