Cryptocurrency trade has been on the rise as of late. According to a 2021 report from Crypto.com, there are now more than 100 million crypto traders across the globe. You may be thinking about joining this demographic and investing some of your money into this virtual currency. But how will you be able to set yourself apart from other traders, and how can you ensure that your crypto investments are worthwhile ones?

You’ll be in the best position to enter into the world of cryptocurrency trading if you have an informed perspective. The most successful crypto traders are studious about the trends, diligent in their calculations, and committed to making good on their long-term investments.

If this is the kind of trader that you want to be, here’s a list of points that you’ll find helpful. This list will guide you to prepare everything you need in order to start a rewarding journey in cryptocurrency trading.

You Need to Know the Risks and the Demands of Taking Cryptocurrency Seriously

The very first thing that you need to be aware of is what’s at stake when you start trading in cryptocurrency. Don’t be deceived by snake oil salesmen who will tell you that crypto is a “magic bullet” kind of investment, because the truth is that it isn’t. The speculative nature of cryptocurrency makes it a high-risk and high-reward kind of endeavor, and you shouldn’t invest any money that you aren’t willing to lose.

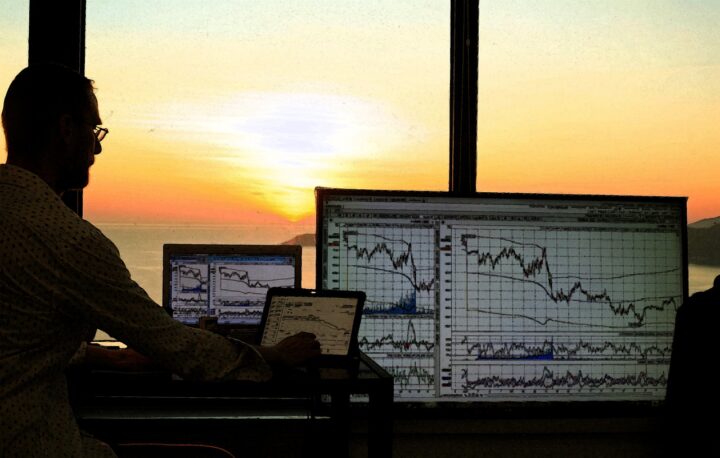

That said, if you acknowledge the risks and you still want to be a successful crypto trader, you also have to dedicate your resources to trading. You won’t be able to get far if you treat crypto trading as an erstwhile hobby. You’ll have to put in the time to study the market, and you’ll have to learn about new technologies that can improve your trading skills. These include trading algorithms, trading analytics tools, portfolio trackers, and portfolio rebalancers. This immersion into the world of crypto trading will allow you to persevere with it through thick and thin, and you will emerge as someone who is in control of their trading experience.

You Have to Learn the Differences between Different Types of Coin

Another factor in your success as a trader is which coin you choose to invest in. The interesting thing about today’s cryptocurrency market is that it is no longer exclusively dominated by coins with high name recall, like Bitcoin (BTC), Ethereum (ETH), Binance (BNB), and Tether (USDT). Traders can opt for other coins that better reflect their priorities. For example, those who want a fully private and anonymous trading experience can explore a privacy coin like Monero (XMR) and store their coins in a dedicated Monero wallet.

The bottom line is that you cannot think of each crypto coin as interchangeable, and you shouldn’t simply invest in one coin because it’s the most well-known of the bunch. Research on the different cryptocurrencies out there and what kind of trading experience you can expect out of them. Choose a coin that’s built on a reliable system, as well as one that can offer you consistent experiences on the blockchain. If you’ve settled on the right crypto for your needs, your trading journey will feel more personalized and more rewarding.

You Have to Keep Abreast of Current Crypto Trends

Cryptocurrency is not the kind of investment that you can leave alone for a long time. Market trends can change by the day. If you aren’t in the loop about the rise and fall of your coin’s market capitalization, you won’t be as well-equipped to make sound trading decisions.

Cryptocurrency is not the kind of investment that you can leave alone for a long time. Market trends can change by the day. If you aren’t in the loop about the rise and fall of your coin’s market capitalization, you won’t be as well-equipped to make sound trading decisions.

That said, if you earnestly want to make good on your crypto investment, you will need to put in the homework of reading daily news about your coin, keeping abreast of updates to its system, and tracking any changes in price. Being aware of current trends, deducing logical patterns, and basing your long-game trading decisions on these patterns will definitely increase your acumen as a crypto trader.

You Should Always Keep Track of Your Trading Capital

One of the day-to-day tasks that you’ll need to do as a trader is to keep track of your trading capital, or how much money you can possibly allot to cryptocurrency trading activities. The smart crypto trader will keep account of their returns and adjust their strategy if these are in the red. Take a page from the most successful crypto traders and manage your trading capital wisely.

Another important issue that you have to address is the security of your trading capital from hackers or other bad actors. Whether you choose to diversify your coin storage or keep your coins in just one wallet, ensure that your capital and your keys are fully protected at all times.

You Should Always Trade with a Cool Head

Lastly, if you want your crypto investment to prosper, you should make all your trading decisions with a cool head and resist the urge to give in to greedy or impulsive trading behavior. Many traders make the mistake of betting all they have on one seemingly good opportunity, only to lose a huge amount. You can prevent this from happening to you by being as calm, rational, and logical about your trading decisions as possible.

In a similar vein, remember that you don’t have to jump on the bandwagon and mimic the behaviors of other traders just for the sake of it. Any decision to buy or sell your coins should be based on your best interests, and no one else’s. When your decisions perfectly align with your goals for investing, you’ll have truly succeeded in your trading journey.

Final Words

In summary, the best approach to take when immersing yourself in the world of cryptocurrency is a levelheaded but purposeful one. Know exactly what you’re in for, keep an eye on your coins every day that you’re trading, and be both careful and deliberate in your decision-making.

Crypto may be unpredictable at times, and there are several factors in the market that you can’t control. But if you can take charge of your money, your goals, and your knowledge of how your coin is doing, you may be well on your way to becoming an excellent crypto trader.

Insightful! Thanks

Thanks! This is very nice