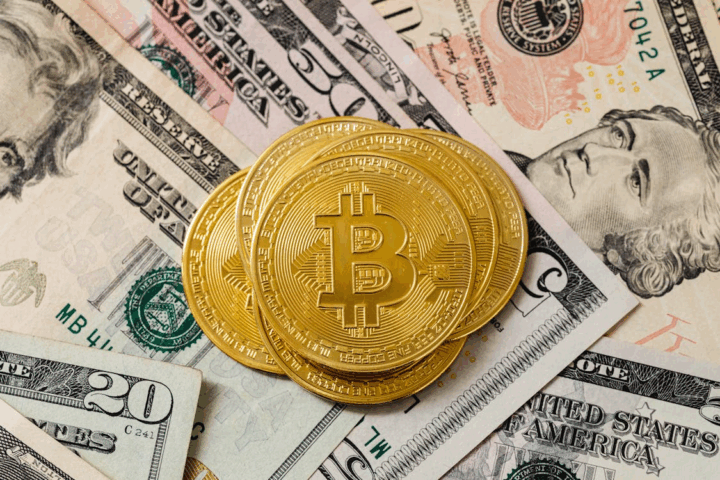

Let’s be honest: these days, handling money feels like a job all the time. Banks don’t pay much interest, prices are always rising, and it seems like everyone is talking about Bitcoin or some new coin they recently acquired. You’re not alone if you’ve been debating whether to retain your money in a bank or invest in cryptocurrencies. Most tech-savvy investors are open-minded about spreading their financial portfolio between fiat and digital currencies.

Forex trading, which involves purchasing and selling currencies to make money, is also familiar to some of these tech-savvy investors. Platforms like AvaTrade make it easy to get started with tools that are good for both new and seasoned traders.

What’s the deal with each choice?

It’s easy to make a bank deposit. You put your money in a savings account or a fixed deposit, and every year the bank pays you a little bit of interest. There is no drama; it’s safe and reliable.

Cryptocurrency is the crazy kid in the realm of money. It’s digital money like Bitcoin or Ethereum that can go up (or down) very quickly. You keep it in an app or a digital wallet, and you are in command of it.

Which One Is Safer?

Let’s be honest: putting money in the bank is safer. Your money is protected in most places. For example, in the U.S., the FDIC will protect up to $250,000 in your bank account. That’s good to know.

Cryptocurrency? Not really. If someone hacks your account or the exchange goes down, it’s your fault. Yes, huge sites like Coinbase are making their security better, but there is still a danger.

In spite of all the newly introduced 2FA, passkeys, and anti-phishing mechanisms by top Crypto exchanges, news of hacks still abounds, and that of software wallets like Safepal, Trustwallet, and Metamask are also rife with such financial losses as a result of hacks and wallet compromises.

How about making some money?

You might get 2–4% interest on your money each year from a bank. It’s not big, but it’s steady and you can count on it.

With cryptocurrency, you could lose all of your money or make twice or three times as much. For instance, Bitcoin experienced a significant rebound in 2023, but it has also experienced sharp declines in the past. Therefore, it’s somewhat like gambling unless you really know what you’re doing.

It is preferable to place your money in a bank when you wish to save for anything significant, such as a home or schooling. But if you have some “extra” money to spend, crypto can be enjoyable and thrilling.

Can I get my money out whenever I want?

When you put money in a bank, especially a fixed one, you usually have to keep it there for a few months or years. If you take it out early, you will lose some interest.

Crypto is incredibly adaptable. You can sell it whenever you want, but the price might not be good when you need the money. Timing is key.

What About Taxes?

Taxes are easy with banks. You tell the IRS about the modest amount of interest you earn and then go on.

Taxes on crypto are harder. In some places, it’s like trading stocks: you have to pay taxes on the profits. In other places, it’s not clear what to do. If you choose this path, be ready to do your homework.

So what should you really do?

Most of the time, financial gurus say to change things up. Don’t put all your eggs in one basket.

Forbes says that a good balance might be:

- Put 70–80% of your money in low-risk things like bank accounts or government bonds.

- A smaller piece (10–20%) goes into risky things like crypto.

- The rest is in items like real estate or stocks.

In this approach, the other areas can make up for the one that isn’t doing well.

Last Thought

This is all about you at the end of the day. Your goals. How comfortable are you with risk?

A bank deposit is ideal if you can rest easy knowing that your money is secure. If you enjoy the rush and can tolerate some volatility, cryptocurrency might be a good fit for you.

Whatever you decide, never stop learning. Making financial decisions doesn’t have to be frightening if you approach the situation methodically. Gaining more knowledge will help you make better choices both now and in the future.